Why I Still Keep the American Express Platinum — My Personal Spin on the Perks

Disclosure: Some of the links in this post are referral or affiliate links. I may earn a commission—at no cost to you—if you choose to sign up for a credit card or make a purchase. I only recommend what I personally use to travel more and spend less

The American Express Platinum is known for luxury travel perks—but what if you barely travel? At $695/year, the annual fee can seem steep. But after breaking it down, I’ve realized this card more than pays for itself—without ever stepping into an airport lounge.

Here’s how I personally use it—and how others can make it work for them too.

Benefits I Actually Use Every Year

$200 Hotel Credit

Valid on Fine Hotels & Resorts or The Hotel Collection (2-night min for the latter)

Must be booked through Amex Travel

I often use this for staycations or trips near national parks

Perks usually include daily breakfast for two (valued at $60) and a $100-$150 property credit—making the total value closer to $360-$410, not just $200

$200 in Uber Credits

$15/month ($35 in December), auto-loaded to Uber app.

Works on Uber rides and Uber Eats.

I use it monthly on food delivery, reducing my dining costs.

Photo via Kaip

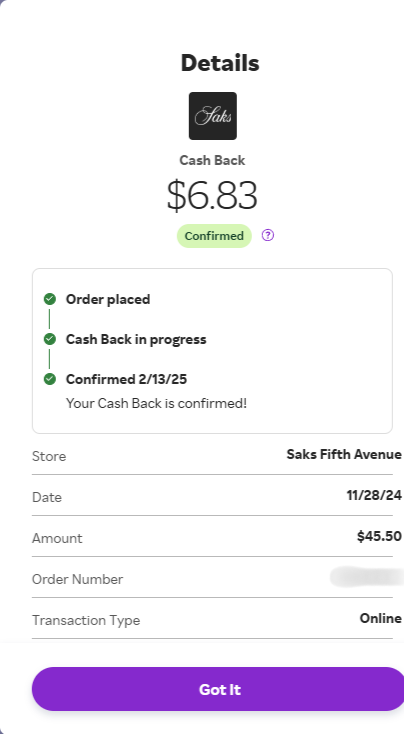

$100 Saks Fifth Avenue Credit

$50 from Jan–Jun, another $50 from Jul–Dec.

I recently bought $50 worth of underwear—completely free.

Stacked with Rakuten at 15% cashback:

Earned ~$7.50 back + Amex Membership Rewards on the transaction.

Got paid to shop. Literally.

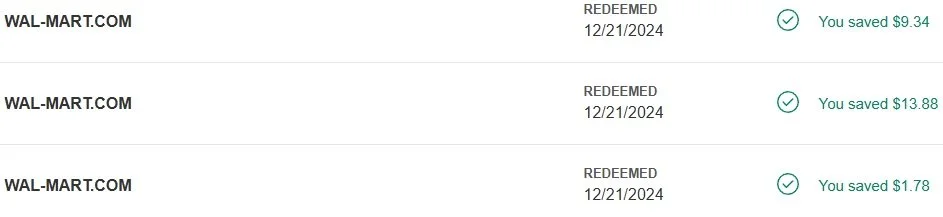

Walmart+ Monthly Credit

Covers the $12.95/month subscription.

Comes with Paramount+, free shipping, and gas discounts.

$240 Digital Entertainment Credit

$20/month for services like:

Hulu, Disney+, ESPN+

Peacock, New York Times and Wall Street Journal

I rotate this based on what I’m watching or listening to.

You can change services monthly, so you’re not locked in.

Amex Offers

Targeted discounts or bonus point offers.

I’ve earned cash back at Best Buy, Home Depot, and streaming services.

These stack with Rakuten or other portals for even more value.

Benefits I Appreciate Having

Even when I don’t use them often, I like knowing these perks are there:

Extended Warranty: Adds 1 year to eligible warranties.

Purchase Protection: Covers theft/damage for 90 days.

Return Protection: Refunds on eligible items merchants won’t take back.

Trip Delay / Cancellation Insurance: Rarely used, but valuable in emergencies.

Travel Benefits Others Might Love

I don’t use these much, but frequent travelers will find tons of value:

Airport Lounge Access: Includes Centurion Lounges, Priority Pass Select (excludes restaurants), and Delta Sky Clubs (when flying Delta). Great for relaxing, eating, or getting work done during layovers.

$200 Airline Incidental Fee Credit: Covers things like seat selection, checked bags, and in-flight snacks. You choose one airline per year to use this with.

$189 CLEAR® Credit: Helps you skip long security lines using biometric verification. Works even better when stacked with TSA PreCheck.

Global Entry / TSA PreCheck Credit: Covers your application fee once every 4–5 years. Speeds up security and customs lines—especially helpful for international travelers.

Equinox Credit: Up to $300/year in statement credits for Equinox memberships. Not for everyone, but a big perk if you’re already a member or want to join.

My Personal Value Breakdown

$200 Hotel Credit

Booked through Amex Travel (FHR/THC).

$160 Hotel Dining/Breakfast Perks

FHR includes ~$60 breakfast for two + ~$100-$150 property credit.

$200 Uber Credits

$15/month + $35 in December, used on Uber Eats.

$100 Saks Fifth Avenue Credit

$50 every 6 months, stackable with Rakuten.

$155 Walmart+ Subscription Credit

Covers $12.95/month, includes Paramount+ and gas perks.

$240 Entertainment Credit

$20/month on services like Disney+, Hulu, Audible, etc.

Total Estimated Value: ~$1,155 - $1,205

Final Verdict

The Platinum card isn’t just for luxury travelers. If you’re intentional, it can be a powerful lifestyle card that offsets its steep annual fee through real, recurring credits. From Uber Eats to streaming services to staycations, it rewards the spending you’re already doing—without needing to set foot in an airport lounge.

If you’re considering applying, here’s my referral link to the Amex Platinum. It helps support this blog and allows me to keep creating content like this.

Just be sure the card fits your spending habits. When it does, it’s one of the most rewarding tools you can have in your wallet.