How I Stack Cashback and Credit Card Points Using Rakuten

Disclosure: Some of the links in this post are referral or affiliate links. I may earn a commission—at no cost to you—if you choose to sign up for a credit card or make a purchase. I only recommend what I personally use to travel more and spend less

I don’t clip coupons or chase deals. I just try to be intentional — especially with purchases I was already planning to make. One of the easiest tools in my stack is Rakuten.

What’s Rakuten?

Rakuten is a free cashback platform that partners with thousands of retailers — from electronics and clothing to travel and subscription services. You can use it in two ways:

Browser Extension: It automatically activates cashback offers when you're on a partner site.

Rakuten Portal: You can also go to rakuten.com, search for a store, and click through their link to shop.

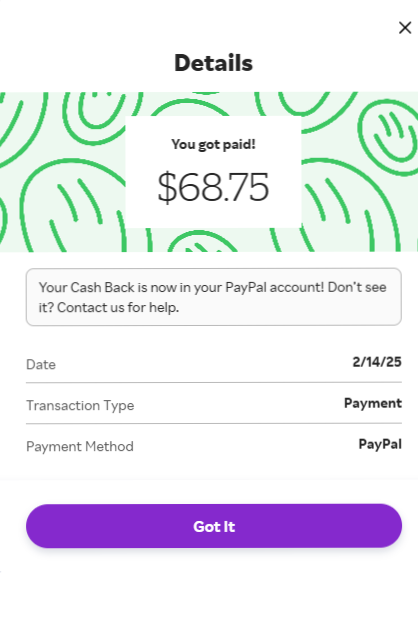

Once you make a qualifying purchase, Rakuten tracks your transaction and confirms your cashback. Payouts happen every quarter (once every three months), either via PayPal or a check in the mail.

Cashback or Amex Points

By default, Rakuten pays cashback in dollars. But if you have an American Express card enrolled in the Membership Rewards program, you can opt to earn MR points instead of cash.

This can be a game-changer:

Earning 1 Membership Rewards point per $.8 of cashback (i.e., $8 cashback = 1,000 MR points)

When transferred to travel partners, MR points can be worth 1.5–2 cents per point or more

If you value travel rewards, switching to points can often yield better long-term value than cash.

If you’re new to Rakuten, use referral link here and you’ll get a $30 bonus after your first purchase.

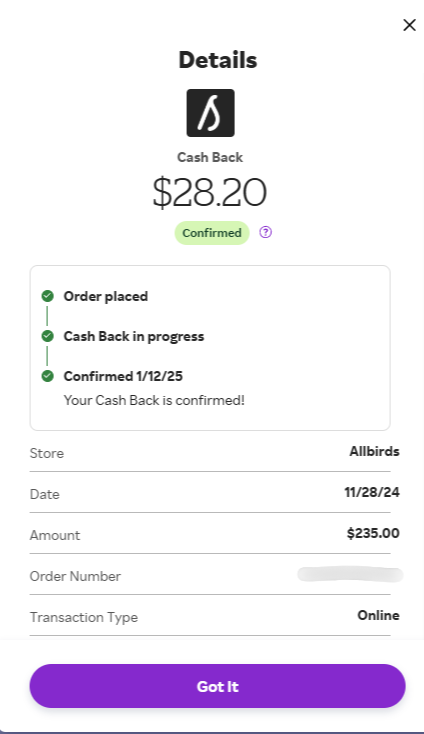

Real Example: $28.20 Back on an Allbirds Order

In late November, I bought a couple pair of shoes from Allbirds for Christmas. Rakuten was offering over 10% cashback at the time.

Order Total: $235

Rakuten Cashback: $28.20

Paid with: My rewards credit card (to earn points + work toward a bonus)

The cashback was confirmed a few weeks later. That’s nearly 12% back, plus credit card rewards on top — for a purchase I was already going to make.

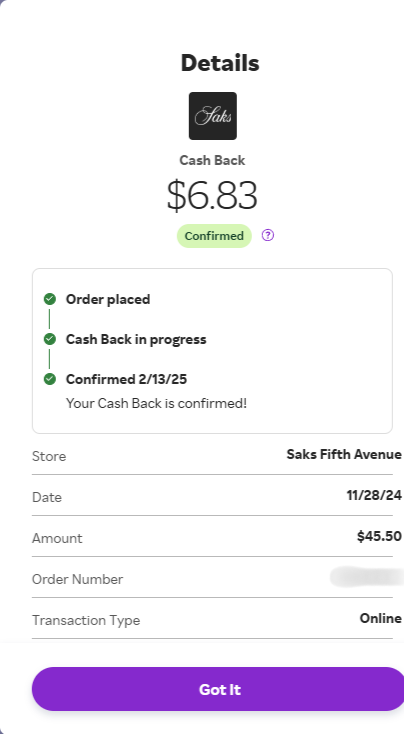

Another Example: Got Paid to Use My Semi-Annual Credit at Saks

I used the $50 Saks Fifth Avenue credit from my Amex Platinum Card to buy $45.50 worth of basics. Rakuten was offering over 15% cashback at the time.

Total Spent: $45.50

Paid with: Amex Platinum Card using the Saks credit (so $0 out of pocket)

Rakuten Cashback Earned: $6.83

Net Result: I got paid $6.83 to use my semi-annual credit

This is why stacking works. A benefit like the Saks Fifth Avenue credit through the American Express Platinum Card can be paired with cashback tools like Rakuten to come out slightly ahead

How I Maximize Rakuten

Rakuten is great on its own, but here are a few tips I’ve found useful:

Use the Browser Extension: It alerts you when you’re shopping on a site with eligible cashback, so you never miss out.

Stack with Credit Card Offers: Like the $50 Amex Saks Credit, or while working toward minimum spends for new cards.

Shop During Multiplier Events: I’ve seen 10–15% cashback on popular stores during holidays or flash events.

Double Dip with Store Coupons: Rakuten still applies your discount code and gives cashback.

Link to Amex MR Points: You can earn Membership Rewards instead of cash if you prefer point-building.

Is Rakuten Worth It?

For me, it’s an automatic addition to my online shopping. It’s not going to make you rich, but if you’re optimizing your spending already — especially with credit card strategies — Rakuten fits right in.

Whether I’m buying something small at Walmart or making a big purchase at Best Buy, I check Rakuten first.

You can sign up for Rakuten using my referral link here and get $30 after your first purchase. It’s free to join, takes 30 seconds, and if you’re already shopping online — there’s really no downside.