Why I Think the IHG Premier is a Keeper Card

Disclosure: Some of the links in this post are referral or affiliate links. I may earn a commission—at no cost to you—if you choose to sign up for a credit card or make a purchase. I only recommend what I personally use to travel more and spend less

How a $99 annual fee quietly saves me hundreds on real-world travel

The IHG Rewards Premier Credit Card is one of the few hotel cards I keep long term. It’s not complicated, doesn’t require much effort, and it consistently saves me money every year.

1. The Free Night Certificate Always Delivers

Each year, I get a free night certificate worth up to 40,000 points. I recently redeemed mine for a stay near Klamath Falls where the rate was nearly $250 with taxes and fees.

There were no blackout dates, no hoops to jump through, and the booking process was simple. For a $99 annual fee, that’s an easy win. I saved more than double what I paid.

2. Perks That Actually Add Value

IHG hotels often come with free breakfast, welcome drinks, and late checkout—perks that make short getaways or road trip stopovers feel a little more elevated without paying more.

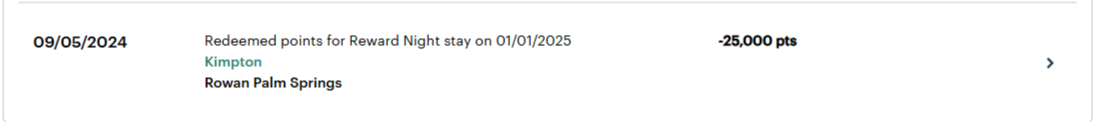

But it’s not all basic stays. I used my annual free night certificate from the IHG Premier card to book the Kimpton Rowan in Palm Springs, where cash rates were over $550 per night. I only had to top it off with 25,000 IHG points. Whether it’s a stopover off the highway or a high-end desert escape, IHG delivers more than most people expect from a $99 annual fee card.

That one redemption alone offset the entire annual fee—and gave me a boutique-level experience in the heart of downtown Palm Springs.

Photo via IHG

3. Easy to Use, Even Without Loyalty Status

You don’t need to chase elite status to get value from this card. The annual free night, point redemptions, and standard perks all hold up without needing to stay 20+ nights a year.

And if you are planning a longer trip, IHG makes it even easier to save — you’ll get the 4th night free on award stays when you book using points. That’s a built-in bonus that can turn a weeklong trip into serious savings.

Whether it’s a one-off road trip or a longer vacation, IHG properties are easy to find, book, and enjoy—no juggling elite tiers or upgrade games.

That kind of low-effort utility is exactly why I keep the card around.

4. Easy to Combine With Chase Ultimate Rewards

While I usually save my Chase points for Hyatt, I love that IHG is also a transfer partner if I need to top off my account. But honestly, I don’t need to transfer points often—the free night certificate does most of the heavy lifting.

And since I’m already using Chase cards for most of my spend, IHG fits nicely into my broader rewards ecosystem.

Final Thoughts

Here’s what I get out of it each year:

Annual free night (worth up to 40,000 points)

Fourth night free on award stays

IHG Platinum Elite status

Global Entry / TSA PreCheck credit every 4 years

Up to 26x points when staying at IHG hotels (with stacking)

For $99 a year, it’s a no-brainer for me. I don’t use it for daily spending, but I keep it for the benefits — and it earns its place in my setup every year.

If you’re interested in adding this card to your setup, you can use my IHG referral link here — it helps support my blog and content, and you may qualify for a welcome bonus too.